The age of digital factoring has arrived

Your money,

Your time.

As the only company in the country, we now finance your company's active invoices 100% digitally, so you don't have to wait months for your customers to pay!

Faster payment, greater effectiveness

Digital factoring is a smarter form of financing than a loan, with which you can get your money at the push of a button instead of waiting for months.

BÁV Faktor is an institution supervised by the Hungarian National Bank.

Digital factoring is a smarter form of financing than a loan, with which you can get your money at the push of a button instead of waiting for months.

We could also say that we "buy" your invoices, so you don't have to wait for your customer to settle them.

From now on, we finance your company's active invoices in a completely digital way, which your partner will pay us afterwards.

While your competitors are waiting for their money, you can gain a competitive advantage and ensure adequate liquidity for your company.

A thirty-day payment deadline? Is that okay?

You issue an invoice, pay the tax, and then wait months for the payment to arrive. But that's over now, because digital factoring® has arrived.

Success stories from our clients

who handle their finances flexible

Sign up and let's speed up the operation of your business together!

Filling out the form is free of obligation, it is only part of the request for quotation process.

This is how it works in practice

After entering some basic company information, you will find out exactly how much the process will cost you.

If you like our offer, you can start uploading your business and customer data digitally immediately.

After the customer qualification is ready, the risk management and financing decisions are made.

In case of a positive evaluation and after signing digital contract, we will pay you a maximum of 90% of the gross value of the invoices.

Repeat every time an invoice is issued, and the financed amount will be in your account the next day!

Who is it for and what is it good for?

Sebestyén

Occupation

CEO

Company size

578M

Problem to be solved

The manager of the shipping company has set a goal of 30% growth by 2022. Due to the continuous expansion, he started thinking about a company loan in order to be able to finance the costs of the organization's growth.

Flexibill's solutions

Réka

Occupation

CFO

Company size

A new startup business

Problem to be solved

As a start-up, the company spent the existing funds on the purchase of quality wines, which it intends to sell on to others, and unexpected costs also arose in connection with the vineyard.

Flexibill's solutions

Andrea

Occupation

CEO

Company size

Medium-sized enterprise

Problem to be solved

Flexibill's solutions

Do you have any questions?

Contact our professional customer service!

We provide a flexible financing framework with no hidden costs

Bank loans are complicated. To be honest, up until now, factoring might have seemed like that as well. However, we have made it simple. After uploading a few documents, our financial algorithm calculates a personalized financing framework and cost for you, so there will certainly be no surprises.

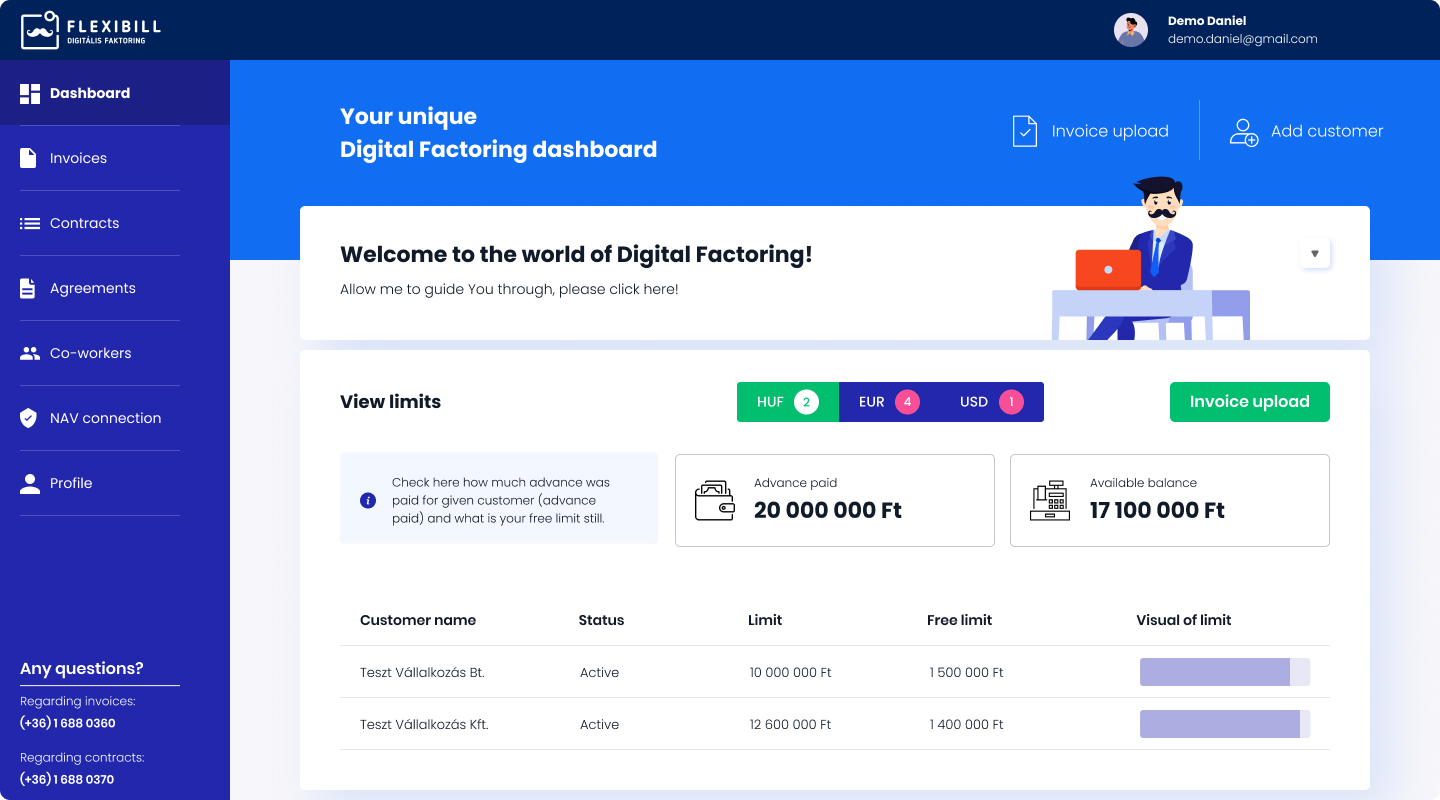

For the first time, you can handle the entire factoring process 100% online

There are no needlessly piled up contracts and you don't have to travel across town just to sign a document in person. If you wish, the entire process takes place online, so not only is administration much faster and more convenient, but we can even finance your invoices on the day of uploading. This is what digital factoring® offers you.

You can make money from your invoices at the push of a button

We put the entire process on a digital basis in order to save you valuable time. So, for the first time, a signature and a push of a button may be enough to make up to 90% of the amount of your invoices available on the same day. Factor only what you want, be it just one or even hundreds of invoices.

Get to know the history of Flexibill

Startup in the "cradle" of a 250-year-old company, new product and process development, as well as a very serious digital development in the field of factoring. BÁV Faktor, a member of the BÁV group of companies, has come up with a new fintech solution called Flexibill.

The CEO of our company, Tamás Rátkai, was asked about the challenges of the factoring market, digital transformation and a unique startup-large company solution.

YOU MIGHT HAVE ALREADY HEARD ABOUT US FROM THEM

Frequently asked questions

Factoring may have been complicated at first, but we have made it brutally easy for you

Didn't find the answer you were looking for? Don't worry!

Factoring is a form of financing that (like a loan) is provided by a bank or factoring house, thus supporting the payment of the invoices of the business that requires the money.

This is especially important in the case of partners where customers often pay only 30-60-90 days after the invoice is issued, thereby hindering the liquidity and growth of the partner company.

With the help of factoring, you can "sell" your company's active invoices to us. In this way, you can get your money immediately, and your partner settles the debt with the factoring house when the invoice expires.

We present the process through several simple case studies, which you can review by scrolling up.

Regarding factoring, the most basic problem for which we provide a solution is the lack of liquidity due to slow, long-term paying customers.

This perfectly supports your goals, whether security and stability or continuous growth are the focus of your business right now.

Some of the benefits you will enjoy with factoring:

- you can easily pay your company's expenses, without layoffs or cutbacks

- your company will not be in trouble if the transfer arrives only after 30-60-90 days

- even in today's uncertain situation, you will regain full control over your finances

- you can take on the next big project without question, you don't have to wait for a referral

- lack of cash flow does not stand in the way of growth (you can hire new people, invest, etc.)

Individuals who are looking for an alternative to a loan for their own use.

Businesses where the supplier and buyer are members of the same customer (debtor) group (e.g. there is an ownership merger between them. (for a more precise definition, see the relevant provisions of the Act Con Credit Institutions and Financial Enterprises and the Civil Code)

Companies operating in highly risky industries in terms of factoring, please contact our colleagues for more information on these.

Enterprises that do not perform sales and service provision activities.

Of course, yes.

You only need to factor the invoices you want, whether it's one invoice or hundreds.

By using the first and only digital factoring® service in Hungary offered by BÁV Faktor, you can immediately finance your active customer accounts.

The task of factoring is much simpler and faster with us, since now the entire process (from registration to uploading documents to specific financing) can be done digitally.

If you use our service for the first time, the process may take 1-2 weeks.

0.5-2.5% of the gross invoice amount, depending on the transaction. For an exact offer, please contact our colleagues.

You will need to upload the following documents to start factoring your invoices:

– Supplier data sheet filled in with the customer's data, signed and dated,

- Customer data sheet - filled out by the supplier for the customers to be factored separately, signed and dated,

– ledger statement not older than 30 days,

– Tax current account statement not older than 30 days,

– Company contract on the part of the supplier + Copy of specimen signature,

– A copy of the signed contract or order for the customers to be factored

If there are several contracts, we ask for all of them if possible.

– Payment experience, customer analytics (preferably in an xls file) for factored customers for the past year, e.g.: 2018.09-2019.09 with a month-end period within three months of the current month, showing the number, amount, original and actual payment deadline of invoices already issued.

We congratulate you in advance on your decision!

Feel free to contact us by email at sales@bavfaktor.hu or by phone at +36 1 688 0360.

In addition, of course, you can also start the process online by filling out the form on the site. In this case, we will contact you with the details.

Sign up and let's speed up the operation of your business together!

Filling out the form is free of obligation, it is only part of the request for quotation process.

Do you have any questions?

Keresd fel kiemelt ügyfélkapcsolat-tartóinkat!

Our expert colleagues are ready to help you.

- Avar Szilvia

- avar.szilvia@bavfaktor.hu

- +36-20/347-6882

- Király Krisztina

- kiraly.krisztina2@bavfaktor.hu

- +36-20/360-7157

- Zdroba-Bádoki Bettina

- zdroba.badoki.bettina@bavfaktor.hu

- +36-20/315-16-03

Do you have any questions?

Contact our professional customer service!

Our expert colleagues are ready to help you.

- (+36) 1 688 0360

- hello@flexibill.hu